As a proactive business owner and responsible employer, gaining a comprehensive grasp of your tax and superannuation responsibilities is vital when it comes to the individuals you engage with.

Whether you’re overseeing a team of casual cellar door staff or coordinating contractors tending to the vineyards in anticipation of the busy upcoming season, a strong understanding of your obligations is not only a legal requirement but a strategic necessity.

Understanding employee versus contractor

The Australian Taxation Office (ATO) is currently considering a recent High Court case decision, and reviewing the impact it will have on worker classification risk.

The ATO have published a decision impact statement, as well as a draft public advice and guidance products for consultation on their website.

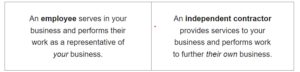

To understand if your worker is an employee or contractor, you need to determine whether your worker is serving in your business or is running their own business.

You do this by reviewing the legal rights and obligations in the contract you entered into with your worker.

To help as a starting point, you can refer to the below two definitions to distinguish between the two:

The ATO further differentiates employees and contractors and has outlined some common distinctions with reference to the legal rights and obligations that arise from the contract you enter into. Just remember that no one feature on its own is definitive. They need to be considered collectively.

It’s important to have a strong understanding of these definitions to ensure you don’t receive PAYG withholding penalties for failing to deduct tax from worker payments who are considered employees by the ATO. In turn, this may also risk denying workers their employee entitlements and other legal implications.

Superannuation for contractors

When you pay contractors mainly for their labour, they are employees for superannuation guarantee (SG) purposes – having an ABN does not exclude the contractor from this. You need to make superannuation contributions for contractors if you pay them:

- On a verbal or written contract that is primarily for their labour (more than half the dollar value of the contract is for their labour)

- For their personal labour and skills (payment isn’t dependent on achieving a specified result)

- To perform the contract work (work cannot be delegated to someone else)

If you enter into a contract with a company, trust or partnership, you won’t need to pay superannuation for the person they employ to do the work.

Payroll tax and payments to contractors

Payments to contractors, in certain circumstances, are considered wages and are liable for payroll tax. Where the relationship between a principal and a worker is determined to be like an employee/employer relationship, payments to the contractor may be taxable.

Each state and territory’s payroll tax legislation is different and may not correspond with the other jurisdictions treatment of contractors.

For further information on the payroll tax treatment of contractors in your region, please refer to your state or territory revenue office.

What’s next?

Every wine business has the choice to engage with contractors. Whether you’re looking to add versatility or expertise to your manpower, the line between employees and contractors should be navigated with care.

By understanding the distinctions across key business areas such as control, integration, remuneration, delegation, tools, risk, and goodwill — you’re well-prepared to ensure smooth contractor engagements that benefit your business and adhere to regulations.

With the complexity and variance involved in compliance, obligations, and contracts — getting expert advice and familiarising yourself with considerations ahead of time can make all the difference.

Connect with a Nexia Advisor to ensure you get the right advice to help navigate contractor engagement with confidence.